Investment advisory services

designed for you

With over 40 years experience in all facets of Retirement Plans,

we have the knowlege and insight to guide

Plan Sponsors and Individuals to their GOALS.

Institutions

Fiduciary Guidance So Retirmement Plan Sponsors Are Confident In Their Decisions.

Latest News & Insights

Articles

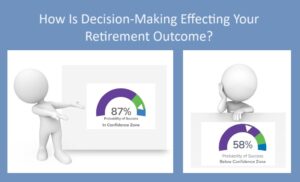

The Power of Intelligent Decision-Making In Financial Planning

February 9, 2024

Seeking Fiduciary Protections

January 26, 2024

Six Financial Must-Dos for 2024

January 11, 2024

A Trick for Required Minimum Distributions

October 13, 2023

Top Tips for Choosing a Financial Advisor

September 13, 2023

“75 percent of Americans are ‘winging it’ when it comes to their financial future.”

CNBC Survey, August 2019

Why Choose Us

WE ARE FIDUCIARIES! That means we work for our clients and their best interest. Did you know not all Financial Professionals are held to the same standard? In fact only about 25% are Fiduciaries.

Our approach begins with getting to know you and your goals. No sales pitches. No pressure.

Play Video

Chip discusses his “WHY” in this short video.

Get In Touch

We would love to hear what is on your mind. Schedule a meeting using the calendar.

Get our news straight to your email inbox!

Sign Up

Copyright 2006-2024 by PrimeTRUST Advisors. PrimeTRUST Advisors is a Registered Investment Advisor and an ERISA fiduciary under Sec. 3(21) or Sec. 3(38).